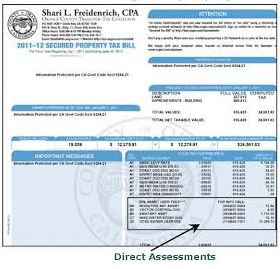

A direct assessment is a special kind of service charge that shows up on your property tax bill. Direct assessments show up on your property tax bill as separate line item fees in addition to the general tax levy. They include fees for services such as sewer maintenance, flood control, and street lighting.

Individual assessing districts. Although they show up on your county property tax bill, the County Assessor does not determine these fees.

In fact, there are over 400 of these assessing districts in Los Angeles County. And to complicate things, each is governed by its own set of policies, ordinances and method of calculation.

Each assessing district has its own method of calculation.

Perhaps you have noticed that your property tax bill has several separate line item fees in addition to the general tax levy. Many of these are Direct Assessments, charges for services provided to the community such as sewer maintenance, flood control, and street lighting, which are of benefit to your property. These charges are not assessed by the County Assessor but by individual assessing districts.